The short version:

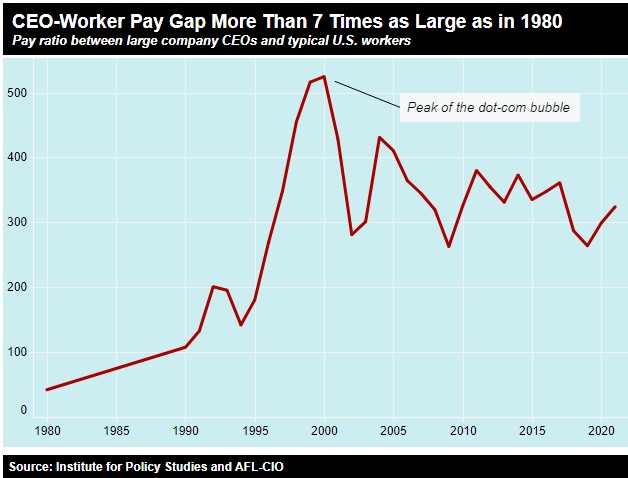

The short version: This article offers insight into why the post-pandemic inflationary trends have been so hard on workers and their families. The spark that set it off was the worldwide spread of COVID-19. The blaze that grew from it was empowered by trends in our economy that began during the 1980s or perhaps before. That’s when our growth engine changed from primarily rewarding labor to mainly rewarding investment, creating what became known as the trickle-down economy. Several illustrations below highlight this change. The first displays how corporate profits have grown since the pandemic. The second shows how middle and upper-tier incomes began to converge and then began to separate in this century. The third shows when worker productivity separated from worker pay. The fourth illustrates how CEO income compared to worker income changed over time. You will see that all began during Reagan’s first term. It points to the fact that corporate America controls our economy, the cost of living, and individual income. That will become more clear during the rest of this article.

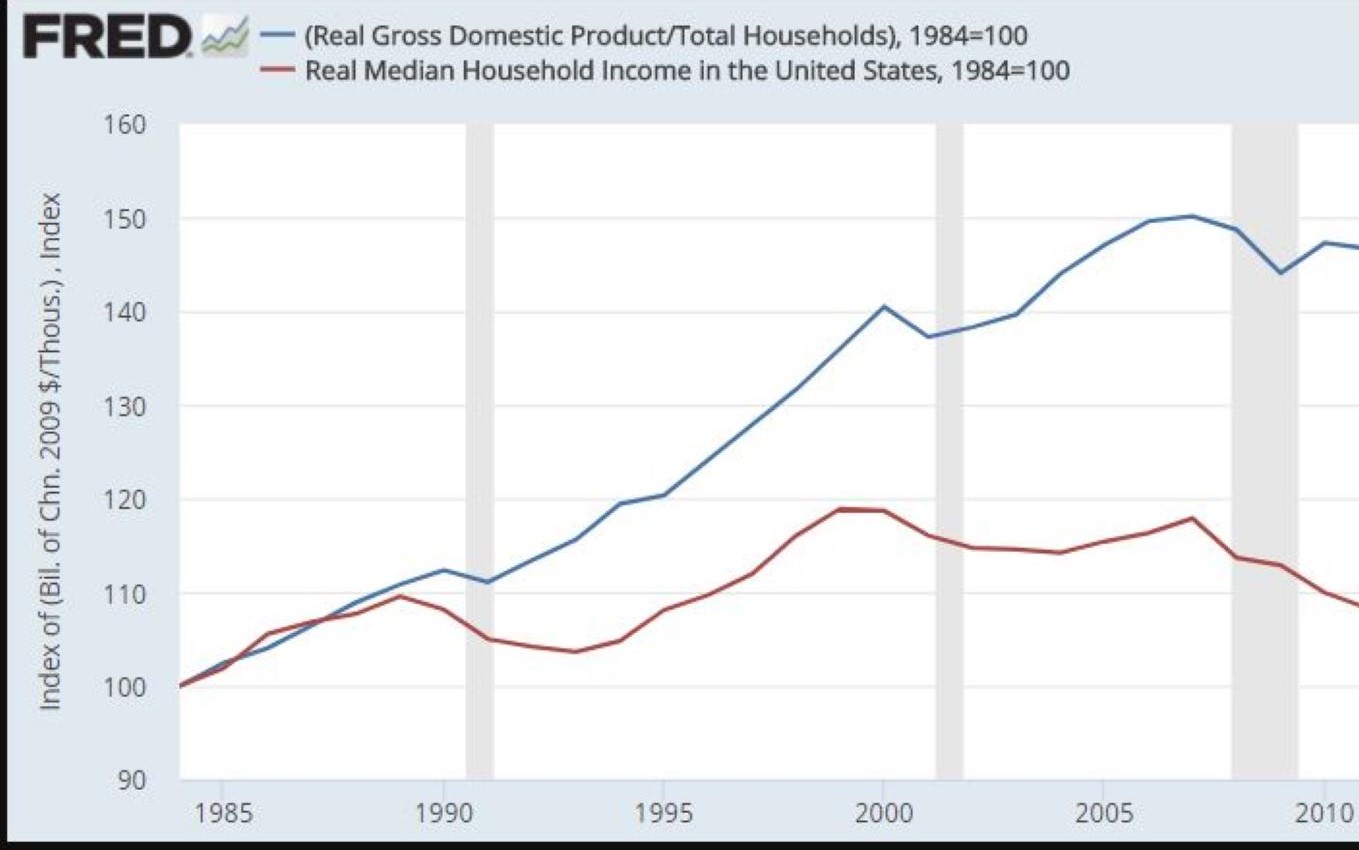

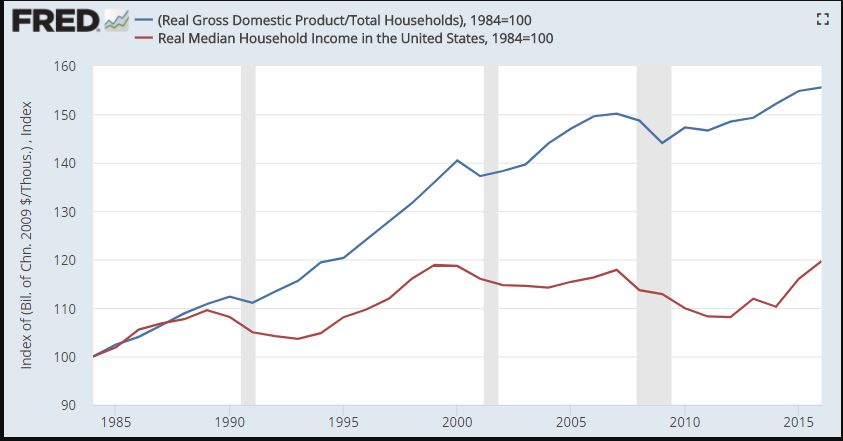

People have been complaining about our economy for some time. Many have, however, failed to identify the actual cause of the problem. The pandemic intensified the conditions that have been moving us toward this place for a very long time. Shortages were created when manufacturing shut down because workers were sent home. When it began to start up, manufacturers had difficulty finding enough shipping to handle long distances. Businesses began to experience significantly higher costs of almost everything. Shipping a container of merchandise from China cost about $1,300 in 2019. That same container shipped in late 2020 cost almost $3,500. Those costs were passed on to consumers along with the usual and sometimes unusual profits for investors. They wanted to make up for lost revenue and adding in a little extra profit helped them do that. In our system, that’s what they do. The graph below shows corporate profits began to rebound in the 4th quarter of 2020 and have sprinted upward since then.

Some years ago our economic engine changed to favor investment over labor. It’s not hard to see how and when that occurred. Just look at what happened in the 1980s. Converting factories from producing war materials to consumer goods was labor-intensive. Workers could make demands on businesses for better working conditions and wages. They did that through increased union power. Those conditions began to put a strain on economic prosperity during the late 60’s and 70’s. The oil embargo in 1973 caused oil prices to quadruple, and that set off a series of events that put the economy into dire straits. It brought about high inflation and reduced employment.

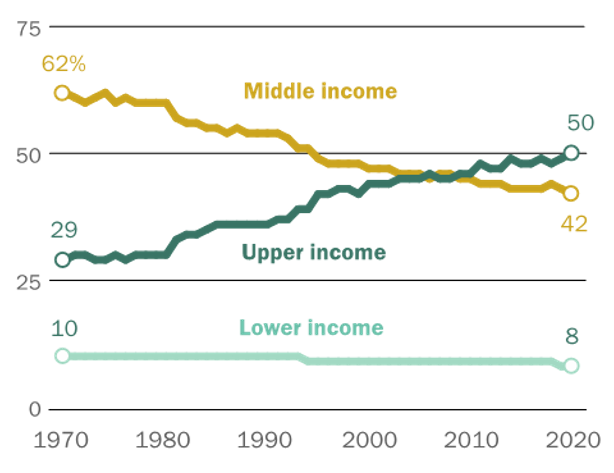

When Reagan came into office, he had with him a group of financial advisors who wanted to deal with those issues by changing the mechanism that drove our economy. The chart below shows the result. It displays 100% of the U.S. economy and measures the percentage that is earned by middle, upper, and lower-income groups. It began in 1970 but the ratio had not changed much before that. If you look closely you will see that it wasn’t until the early 80s that the middle and upper income lines began to move toward each other more quickly. Middle-income earnings began to fall as a percentage of all income, while the upper-income percent was rising more quickly. The lowest wage earners’ percentage of total economic value has changed little.

I’m going to state the obvious here. If middle-income earners were sharing 62% of all economic income they would have more to spend on the things they need or want. We will never return to that point but we can at least stop the erosion of the percentage of income middle earners do have.

David Stockman initially headed Reagan’s economic team as Director of the Office of Management and Budget. He was a politician who had little background in economics. Stockman is given credit for being the “Father of Reaganomics”. He resigned in 1985 after a lengthy article was published quoting him as saying, “None of us really understands what’s going on with all these numbers”. He also said the 1981 tax cut was a Trojan horse. What they were really doing was trying to install “trickle-down” economics. He said, “Supply-side is trickle-down”. It was the shift from the worker-powered demand side to investor-powered supply-side economics that describes what happened. Stockman had help from very influential economists in making that change.

Arthur Laffer was a member of Reagan’s Economic Policy Advisory Board. He is known for his contention that taxes above a certain level will negatively affect economic activity and lower tax revenue. He created what became known as the Laffer curve to illustrate this proposition. Laffer didn’t present any actual numbers or try to pinpoint an ideal tax rate. He supported the argument that lower taxes on business and individual income will stimulate spending, create economic activity, and actually cause tax revenue to rise. The investment income generated will trickle down to lower-income individuals so everyone will be financially better off. Buying into the curve, even without any data, allowed Reagan’s administration to promote the tax cuts with broad, unsubstantiated promises.

Milton Freedman was a Nobel Prize-winning economist who supported free-market policies over government intervention. He opposed almost all of the policies that had been used during the Depression and after the war to return the country to a peacetime footing. He famously believed the only obligation an entrepreneur had was to maximize the return on investment. Any effort to have an impact on society was misplaced. He saw employees as tools to be used to make investments successful. Well, maybe that last part is a bit overstated but you get the idea. It took 40 years but we are finally seeing this idea put into practice by the current administration with its emphasis on stopping DEI efforts in business and elsewhere.

Reagan was above all else a promoter who had a set of economic and social policies he wanted the country to adopt. And they did. In his inaugural address, he told us “government is not the solution to our problem; government is the problem.” That idea has become the cornerstone of Republican governing philosophy since that time. When Republicans have controlled the levers of government, they have cut regulations on business activity and reduced taxes with the promise of increased economic activity that will benefit all. They’re still selling trickle-down economics today. It never has worked out as they claim. It has allowed wealth to accumulate for the top earners more quickly with each tax cut.

The numbers make it easy to see. Before Reagan’s term, worker productivity and income moved at about the same rate. If you produced more, you were paid more. After his term, productivity has grown far faster than worker pay. Increasing productivity at a lower cost translates into higher profits and return on investment. This is not going to change until we elect people who want to change it. Republicans do not want to change it. Democrats do.

Another way to look at business financial success flowing to the top is through CEO’s income compared to worker pay. CEOs were paid 399 times as much as a typical worker in 2021. Their pay has gone up 1,460% since just before Reagan took office.

We all know our system of rewarding effort is out of control. According to Fortune magazine in 1980, at the start of Reagan’s term, there were 13 billionaires in the U.S. Adjusted for inflation, the richest of those was worth $6.15 billion. Today, there are more than 748 billionaires with a combined wealth of about $5 trillion. One example is Elon Musk who was recently paid over $50 billion as CEO of Tesla.

Cutting taxes and regulations on how businesses make money does little to help people who earn a salary or an hourly wage. The Reagan revolution wasn’t about making most people better off. It was about stopping the erosion of control the upper economic class and corporate entities had over our economy that had occurred after the war and into the 70s. They succeeded. It’s up to us to get this economy working for workers again. To do that, we need to change the tax structure and make it easier for workers to have a say in their income and working conditions. We certainly don’t need another tax cut that primarily benefits the highest-income earners. Every time we elect Republicans in our elections that is what will happen. Stop it.